Similarly, the company does not sell all its inventory in a single batch. When a company buys inventory, it does not make it at a single time. It's ok if you first want to understand how the cash conversion cycle calculator works.ĭuring the CCC, accountants increase the inventory value (during production), and then, when the company sells its products, they reduce the inventory value and increase the COGS value. The above process has the following name: Cash conversion cycle (CCC)**, and will be vital for understanding the applications of the FIFO method calculator. The company receives its payment for the products sold (including any sale given on credit), pays its vendors, and with the remaining cash, re-start the process. Normally, the larger the revenue, the larger the profit. Companies call this cost, cost of goods sold (COGS).

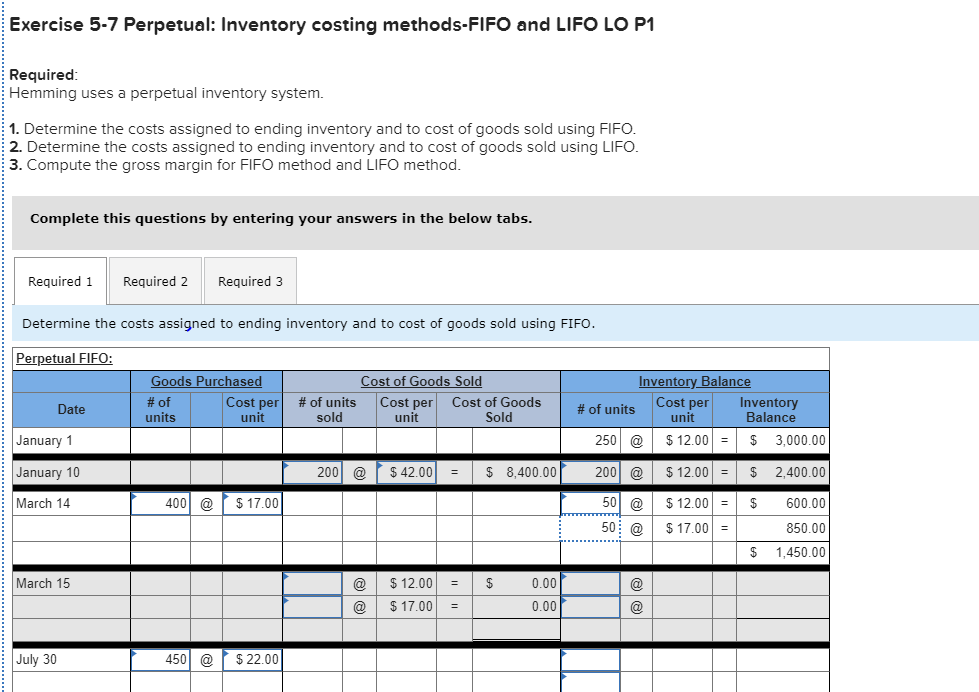

The company then sells the product at a certain price over its cost of manufacture to earn a profit. The company's financial statements includes the latter under the heading accounts payable. For acquiring such inventories, a company uses cash, but it can also get these products on credit. The company buys inventory such as steel, microchips, shoes, adds value to the raw materials, and produces a good that they can sell. It also determines the cost of the goods when being sold.įirst, it is essential to recall how a typical business operates: First-in, first-out (FIFO) is a method for calculating the inventory value of a company considering the different prices at which the inventory has been acquired, produced, or transformed.

0 kommentar(er)

0 kommentar(er)